Why Do Students Need Finance Assignment Help?

The aspects of assets and liabilities studied within a specified diameter of investment and involve considering uncertainty and investment risk are termed finance. Business finance refers to capital funds and credit funds invested in the business. Financing means making money available when it is needed. It can be defined as planning, raising, managing, and controlling all the money used in the business. In academic life, students are asked to prepare assignments on finance. Many students complete it independently, and many struggles with their tasks. For such students seeking finance assignment helpers, they get expert opinions in understanding a company's financial position.

A company's financial position is analysed through its finance. Financial accounting keeps the record of the financial transactions of the company. The purpose of financial accounting is to give information about the company's value to others to find a suitable company to invest in.

According to the finance assignment writer experts, finance is divided into three segments:

- Corporate Finance

- Public Finance

- Personal Finance

We have outlined the description of major three segments of finances.

Corporate Finance

Corporate finance is the financial sector that relates to any business organisation's investment, principal capital and running money.

It is involved to manage finances that are related to any organisation. Corporate finance is also linked to the management of capital of the business or organisation, including its increment. Some of the main aspects of corporate finance are:

- Principal Capital- The principal capital which increases upon the investment is also managed under corporate finance. It declares and maintains the share capital of investors along with the fund of shareholders. The financial analysis, which includes cash flow, cash management, cost-cutting, and an idea of implementation of finance, is controlled by this segment.

- Financial Policy- Financial policies of an organisation that caters to the possibility of success of an organisation is managed by a team of management. Such managements are mostly handled with preciseness to understand the role and strength of finances. While preparing an assignment on such a topic, a student should always consult a finance assignment help online expert and prepare an outline of the assignment.

- Combination- The combination of risk and profitability participates in this component of finances. Corporate finance is constructed with an assessment while understanding the value of an asset of an organisation. The understanding of stock and the revenue generation process holds maximum strength to the financial management and financial growth of any organisation.

- Finance Management- The management of a project which requires cash flow to execute. It also involves evaluation before execution. Post analysis of a project is also necessary to understand the return on investment, which can help identify prospects.

- Budgeting- Finance budgeting is essential for an organisation to conduct as it determines the precise evaluation of an organisation and its assets. Financial, Business budgeting also plays a crucial role to execute any new plan or deciding any recurring expenditures.

- Corporate Finance Management- Corporate Financial Management can also bring new ideas into implementation for further growth of an organisation. The Marketing, management, and monitoring of cash also include the cash investment of a shareholder or investor.

- Corporate Finance- Corporate Finance is also structured with the implementation of loans that procure could from a bank or financial institution in the form of a short or long-term loan. However, the loan procured from a bank or financial institution is mostly collateral-based.

To cover all these aspects of corporate finance in writing assignments, many students put irrelevant information, which leads to bad scores. So, it is better to choose a finance assignment help online experts for input on how to write your assignment.

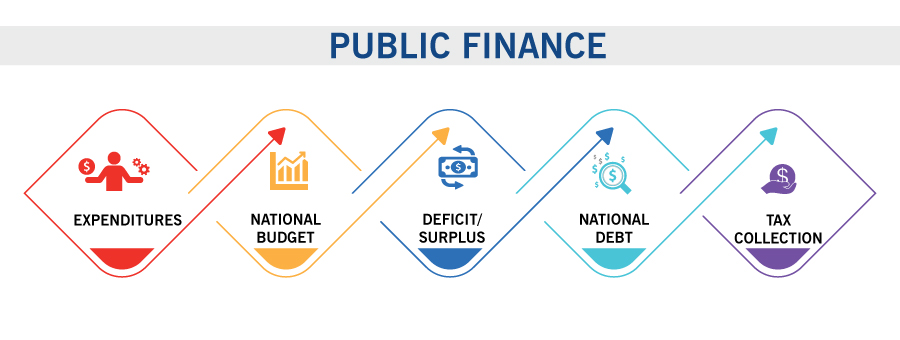

Public Finance

The public organisation often termed a public limited company, indulged with the public to carry out its objective or source of income. The public organisation includes schools, nursing homes, hospitals, agencies, etc.

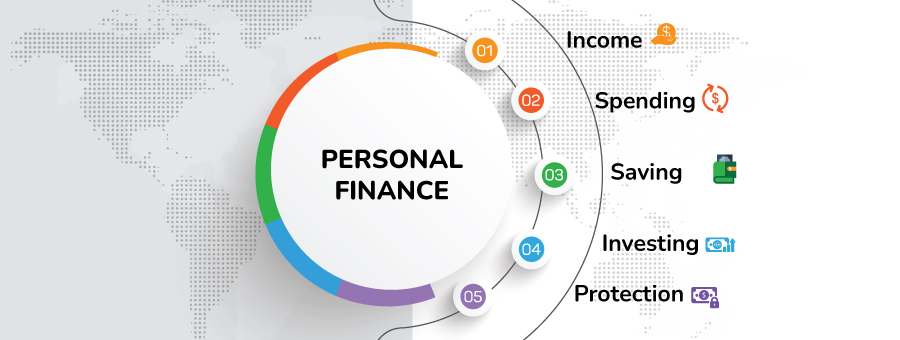

Personal Finance

Personal finance involves personal finances and acquiring finances to fulfil different requirements involved individually. Personal Finance can also indulge the procurement of loans for education, insurance or real estate needs, and much more. It also involves the risk of personal events involving substantial emotional investment and the risk of managing finances in case of a personal emergency.

Writing A Finance Assignment

An assignment of finance is a crucial scope to understanding the field of finance and its core areas. Expert finance assignment help is better to grab while writing an assignment. The experts intend to study the subject in-depth while providing finance homework help.

To write an assignment, it is essential to explore new areas to acquire more in-depth knowledge and further information on the subject. Writing an assignment requires deep knowledge about the issue along with an implementation of it.

Assignment writing is reckoned as a vital part of an academic session that further bestows a better grade. A student needs to use and explore resources to gain new information about the subject. However, most universities tend to supply sufficient resources for completing an assignment. While writing an assignment, it is crucial to consider a topic for which you can always consult your teacher or get in touch with online finance assignment help experts know more about the most trending topic of the domain.

A topic relates to exploration and delivers a better chance to understand more about the subject. It is also cardinal to write an assignment with a purpose. An assignment should be concluded with new information about unengaged areas that can better study the subject. As per the leading financial assignment help experts, the content of an assignment must be authentic and should relate to the topic.

Want An Online Finance Assignment Help Service across the globe?

The most trusted and preferred finance assignment help experts across the globe will be found only on LiveWebTutors. Online assignment help provides companies like LiveWebTutors offer the necessary support to young minds. Students don't have to wait for anyone to get free from their homework tasks and resume their studies smoothly. Therefore, our experts provide online finance assignment help services round the clock and help with almost all finance topics.

It is advisable to seek the best finance assignment writing services from our finance tutors to better understand and know about finance.

Hire LiveWebTutors For Your Finance Assignment Help

Being one of the best Finance Assignment Help services, we will assist you with superior custom writing services as per your needs. Our assignment experts providing finance assignment help will make sure to submit the assignment before the deadline so that you can proofread the file before submitting it.

We, at LiveWebTutors, are highly appreciated for providing the best finance assignment help online across the globe. Now, get your assignment completed by our team of finance assignment help experts who ensure to provide plagiarism-free content. We also guarantee to offer you a thorough analysis and conscientious study of the subject. You will be assured to receive your assignment within your defined timeframe. Our Finance assignment help professionals are available 24*7 to answer all your queries. Call us now and avail the best discount for your assignment.